In the fourth quarter, Tesla’s financial results fell short of analysts’ expectations as the company’s automotive revenue only grew by 1% compared to the previous year. As a result, the company’s stock experienced a decline of nearly 6% during after-hours trading.

Here are the key numbers:

- Earnings per share: 71 cents, adjusted vs. 74 cents expected by LSEG, formerly known as Refinitiv.

- Revenue: $25.17 billion vs. $25.6 billion expected by LSEG.

The revenue of Tesla saw a 3% growth compared to the previous year, reaching $24.3 billion. However, the operating margin for the quarter was 8.2%, which is lower than the 16% from the same quarter last year, but slightly higher than the previous quarter’s 7.6%.

The modest increase in revenue from automobile sales can be attributed to the decrease in average selling price, which was a result of significant price reductions globally in the latter half of the year. In comparison to the previous year, net income for the quarter saw a significant rise, reaching $7.9 billion or $2.27 per share, compared to $3.7 billion or $1.07 per share. This increase can largely be attributed to a one-time noncash tax benefit of $5.9 billion.

According to Tesla’s investor presentation, the company anticipates a potentially lower vehicle volume growth in 2024 compared to the growth rate seen last year. This is attributed to the company’s focus on launching its “next-generation vehicle” in Texas. Tesla has advised investors that it is currently in a transitional phase between two significant periods of growth.

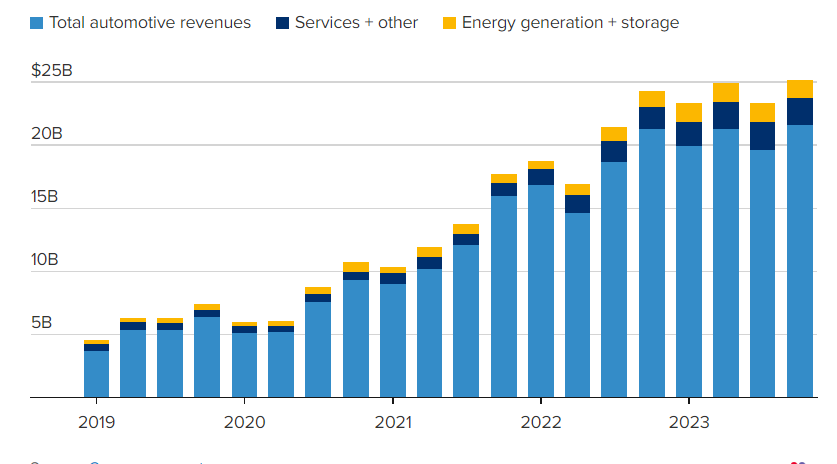

Tesla quarterly revenues (By segment Q1 2019–Q4 2023)

During the earnings call, CEO Elon Musk was questioned about his intention to own 25% of Tesla and whether this should concern investors. The query was prompted by a tweet from Musk where he expressed his desire to gain that level of voting control in order to transform Tesla into a prominent player in the field of AI and robotics.

In response to the issue at hand, Musk expressed his reluctance to be subjected to the decisions of an arbitrary shareholder advisory board and suggested the idea of implementing a dual-class share structure.

Musk specifically pointed out the challenges posed by proxy advisory firms such as Institutional Shareholder Services (ISS) and Glass Lewis, as well as activists who infiltrate companies and propose unconventional ideas. In referring to ISS, Musk humorously mentioned that he sometimes calls the group “ISIS,” drawing a parallel to the Islamic State.

Executives of Tesla refrained from providing any specific information regarding the production timeline of their humanoid robot named Optimus when questioned.

Elon Musk expressed his belief that Optimus, a humanoid robot developed by Tesla, has the potential to surpass the value of all other aspects of the company. He explained that Tesla’s expertise in automotive technology can be effectively applied to the robot, considering that a car is essentially a four-wheeled robot.

Tesla CEO Elon Musk stated that Optimus is currently the most advanced humanoid robot in development worldwide. Notable competitors in this market include Boston Dynamics, Agility Robotics, and Figure. Additionally, there are other robotics companies like Sanctuary, Apptronik, 1X, Fourier, and Unitree that are focusing on creating dexterous manipulation hardware, which imitates human hand movements.

During a recent call, Musk expressed his optimism about Tesla’s ability to ship a certain number of Optimus units next year. However, he did not provide specific details regarding their capabilities or cost. Musk acknowledged that he tends to be optimistic when it comes to timelines.

Cybertrucks hit the market

In the recent period, Tesla commenced the sale of Cybertrucks to its customers. According to the investor presentation, Tesla anticipates a slower production ramp-up for the Cybertruck compared to other models due to its intricate manufacturing process.

Tesla also mentioned that it has the capability to manufacture over 125,000 Cybertrucks annually. During the earnings call, Elon Musk referred to the Cybertruck as both their finest product and a vehicle that captures attention.

“I see us delivering somewhere on the order of a quarter-million Cybertrucks a year,” he said, without giving a precise timeframe.

Tesla reported strong financial results for the full year, with automotive revenue reaching $82.42 billion, marking a 15% growth compared to the previous year. Despite being a smaller division within Tesla’s business, the energy division showed promising performance, experiencing a significant revenue increase of 54% to $6.04 billion.

This division primarily focuses on selling solar energy generation and energy storage systems. Additionally, Tesla’s “Services and Other” revenue also witnessed growth, rising by 37% to $8.32 billion when compared to the previous year.

In the quarter, Tesla reported a decrease in operating income to $2.1 billion compared to the previous year. The company attributed this decline to the lower average sales price of its vehicles and an increase in operating expenses, which were partly influenced by AI and other research and development projects.

Tesla’s spending on R&D rose to $1.09 billion from $810 million in the previous year, but it was slightly lower than the $1.16 billion spent in the prior quarter.

During a presentation to its shareholders, Tesla announced the release of an upgraded version of its advanced driver assistance software, which is known as Full Self Driving Beta or FSD Beta. This software does not transform Tesla vehicles into autonomous cars, as they still require a vigilant driver behind the wheel.

By the conclusion of 2023, Tesla had a global network of 5,952 stations providing a total of 54,892 Supercharger connectors for drivers to utilize. The value of Tesla’s stocks has declined by approximately 16% since the beginning of this year.

source: CNBC