When faced with the challenge of living from one paycheck to another, unforeseen expenses can throw off our plans. However, there are early payday apps available that provide a temporary solution to help us cover these unexpected costs.

Early payday apps are a recent innovation that allows individuals to access quick cash before their next paycheck. Unlike payday loan lenders, these apps typically charge significantly lower fees or no fees at all.

Instead of making money through interest charges, the app developers rely on voluntary tips or membership fees. This approach of charging lower costs makes cash advance apps a practical choice for those who need financial assistance before their next payday without falling into a cycle of accumulating debt.

You Might Also Like:

1. Earnin

Early Payday Apps are mobile applications that enable users to borrow money quickly and conveniently before their next paycheck, without incurring any additional fees or interest charges. One such app is Earnin.

Upon signing up for Earnin, users are required to link their bank accounts, allowing the app to verify their payment schedules. To calculate the amount users are eligible to borrow, the app tracks their working hours either through their phone’s GPS or by manually submitting a timesheet.

The app then determines the user’s hourly pay rate based on the amount of money they receive through direct deposit. With Earnin, users can withdraw a portion of their estimated earnings, ranging from $50 to $750, depending on their repayment history and income. However, there is a daily withdrawal limit of $100.

The app automatically deducts the borrowed amount from the user’s bank account once their next paycheck is deposited. It’s important to note that Earnin does not charge any fees for this service. Instead, they generate revenue through voluntary tips provided by users.

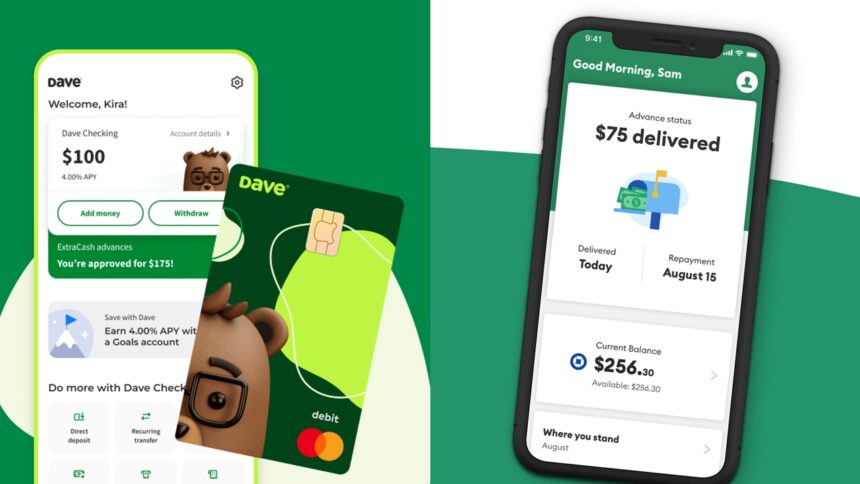

2. Dave

If you’re facing budget cuts due to overdraft fees, the Early Payday Apps can assist you. With the Early Payday app, it actively seeks out possible overdraft situations, such as upcoming bills, and notifies users before their accounts become overdrawn.

Additionally, the app offers a personalized budget feature called “Yours to Spend” which takes into account your income and past expenses to estimate the amount you can freely spend.

If you find yourself in need of money for an upcoming expense but don’t have the funds available, you can turn to Early Payday Apps. This app, called Dave, offers a small advance to help cover your expenses.

The amount of the advance is determined based on how much you can afford to pay back from your next paycheck. Once your next payday arrives and your paycheck is deposited, you are expected to repay the interest-free advance.

Furthermore, the Dave app can assist individuals in discovering additional sources of income in the gig economy. A side hustle refers to an extra job that one takes on alongside their primary employment, often offering more flexible working hours and compensation.

Engaging in a side hustle can serve as a viable alternative to resorting to short-term loans, as it provides supplementary earnings between pay periods. The monthly fee for a Dave membership is just $1, and users have the option to provide additional financial support through tips.

Dave also offers a spending account that users can opt for, featuring a convenient feature that enables paychecks to be deposited into the account up to two days in advance.

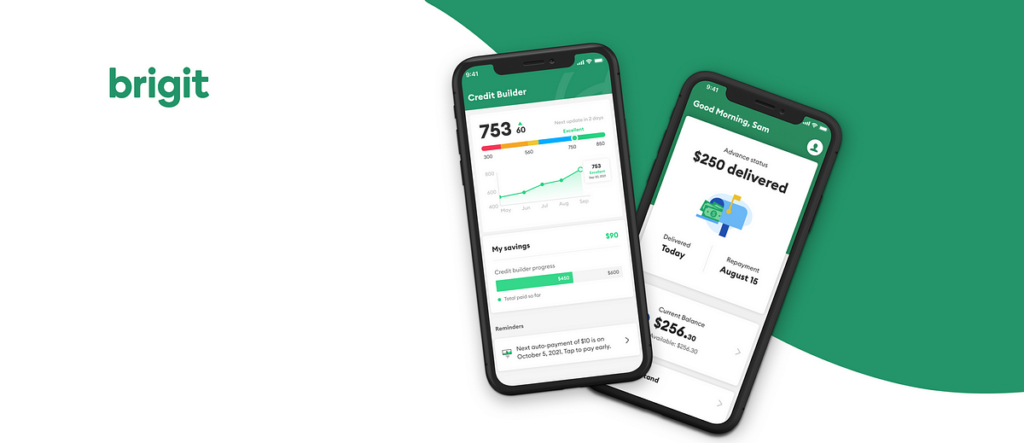

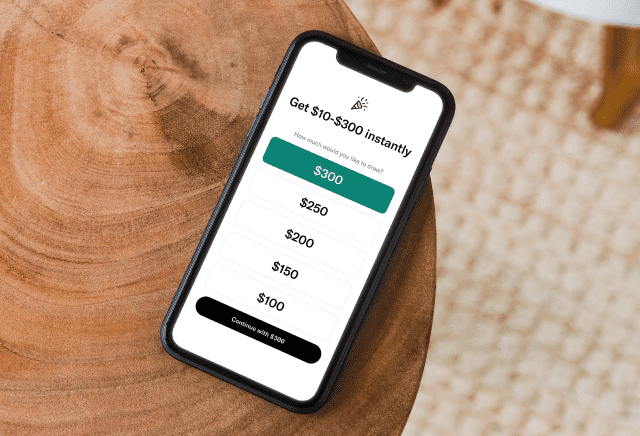

3. Brigit

If you’re in need of a little extra cash between paychecks, Brigit is an app that can help you manage your budget and provide cash advances. In order to qualify for an advance, you’ll need to connect your checking account to the app.

This checking account should have a history of at least 60 days, a positive balance, and at least three direct payroll deposits. Brigit will assess your bank account and spending history to assign you a Brigit score, which will determine if you’re eligible for instant cash. You could potentially qualify for up to $250 in cash advances. Once approved, Brigit will set a due date for repayment of the loan.

If you meet the requirements, you can receive instant cash through the Brigit app. Additionally, Brigit offers an automatic transfer feature that can send money to your bank account when there is a possibility of overdrawing. Similar to the Dave app, Brigit can assist you in finding a part-time job to earn additional income during times of need.

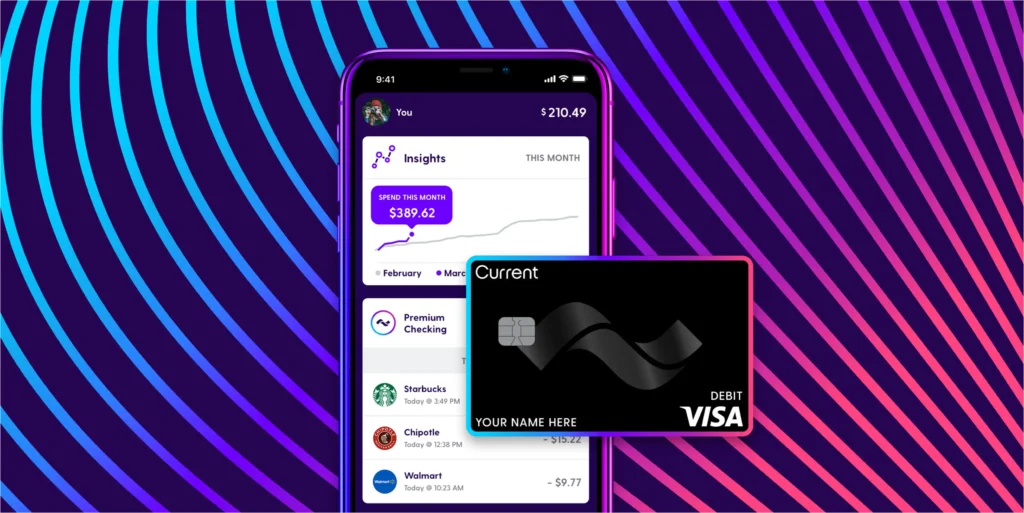

4. Current

Early Payday Apps is a mobile app-based checking account called Current. It aims to assist users in reducing fees and improving budgeting skills. The app provides cash advances in the form of free overdraft coverage.

By having a Current account, users can receive direct deposits up to two days earlier and enjoy fee-free overdraft coverage. New account holders can have overdrafts covered up to $25, and this limit can be increased to $200 over time.

By using a Current debit card for your purchases, you have the opportunity to earn points on qualifying transactions made with participating merchants. These points can later be redeemed for additional cash.

Additionally, Current has a feature that instantly releases pre-authorized holds on purchases with variable amounts, such as those made at gas stations. Normally, these holds can tie up your funds for up to 10 days, but with Current, the hold is promptly released and the funds are returned to your account.

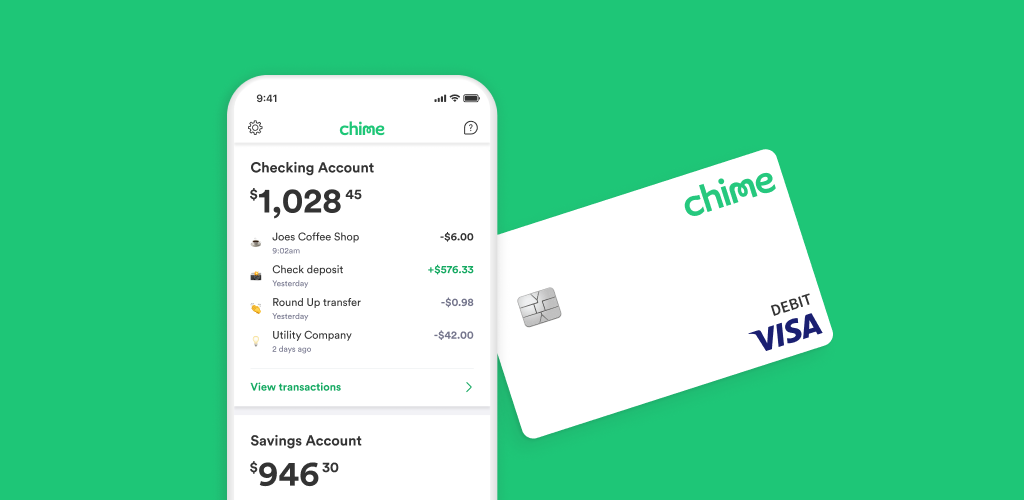

5. Chime

Chime is a mobile application that is linked to Chime’s Checking Account. This app allows users to receive their paychecks through direct deposit up to two days before their scheduled payday.

By utilizing the Chime app, users will receive notifications for any new transactions, helping them monitor their spending habits and identify any unauthorized charges.

In the unfortunate event that a user misplaces their debit card or notices any suspicious activity, they have the ability to quickly disable the card through the app.

Chime offers a convenient service called SpotMe that allows users to overdraw their accounts by up to $200. However, new users have a limit of $20 for overdrafts.

The amount overdrafted is deducted from the user’s next paycheck, providing a helpful solution to cover expenses and avoid overdraft fees.

Chime accounts are free to use, and instead of charging bank fees, Chime earns revenue from fees imposed on merchants for each transaction made with the debit card.

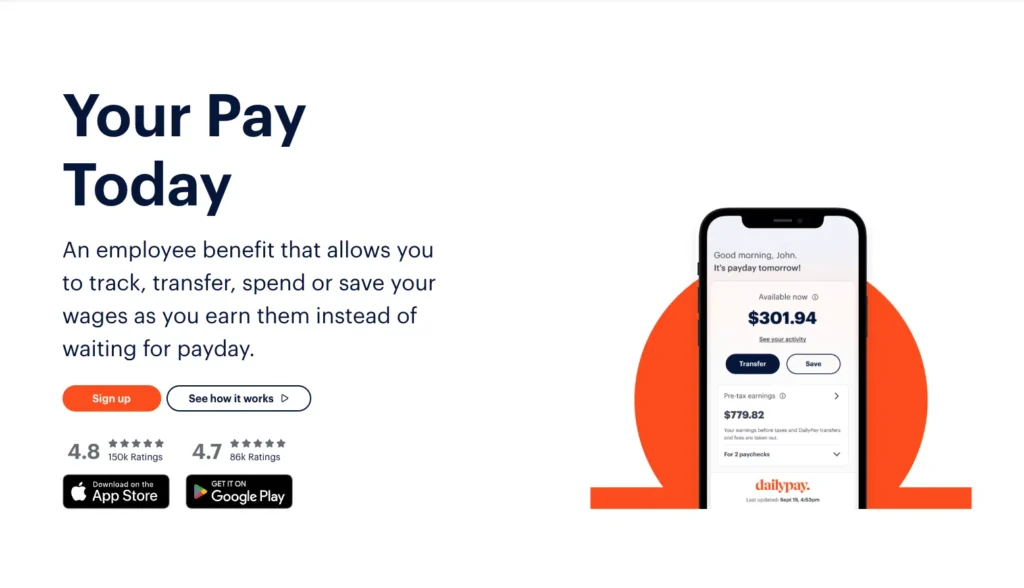

6. DailyPay

The Early Payday Apps, such as DailyPay, are specifically created to provide employees with greater control and flexibility over their paychecks. With DailyPay, employees have the option to transfer their earnings from hours worked in advance, even on a daily basis.

Unlike certain other early payday apps, the funds transferred through DailyPay do not require repayment as they are already earned income. However, the transferred amount will be deducted from the employee’s usual weekly or biweekly paycheck.

With Early Payday Apps, such as DailyPay, you have the flexibility to transfer funds to your checking account, savings account, or debit card. This convenient app allows you to make transfers up to $1,000 per day, subject to a varying fee.

However, in order to utilize this service, your employer must be registered with DailyPay. Each early payday transfer made through the app will incur a varying fee.

7. Empower

The Early Payday Apps by Empower provide a range of financial services including cash advances, credit lines, budgeting tools, and bank accounts.

Compared to other competitors, Empower offers a faster funding time of one day for cash advances, and users also have the option to pay an additional fee for instant delivery of funds within an hour.

The app also features an automatic savings tool that allows users to choose a specific amount from each paycheck to transfer from their checking account to their savings account.

Alternatively, users can utilize the app’s artificial intelligence feature to automatically save money by moving funds from their checking to savings based on their weekly savings goals.

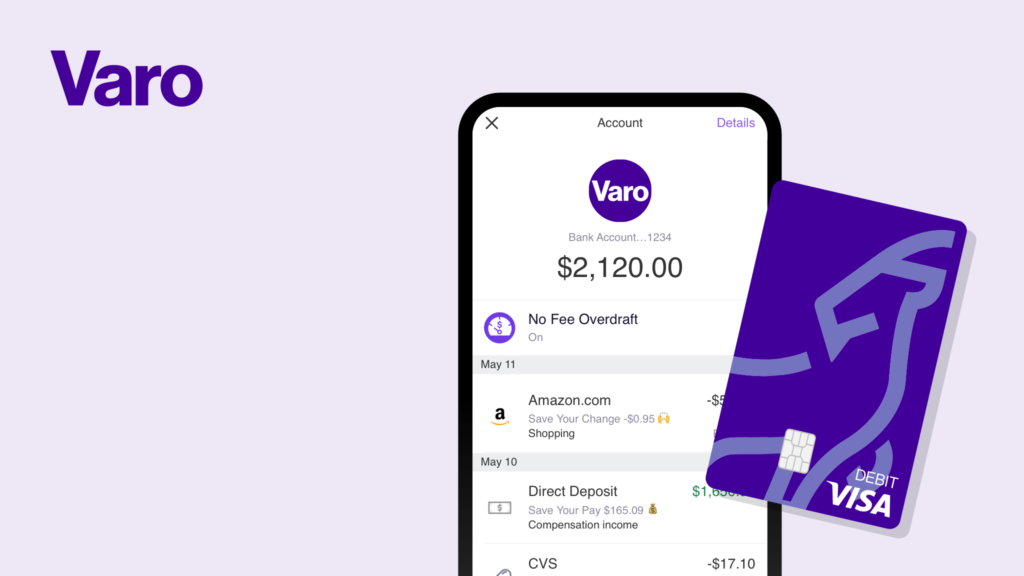

8. Varo

Varo provides early payday apps that allow eligible banking customers to receive cash advances up to $500 instantly. While Varo promotes “0% APR” cash advances, there is a mandatory fee associated with each advance, which can be quite high.

Borrowers may have to pay up to $40 in fees to borrow $500. In comparison, other cash advance competitors typically charge a small optional fast funding fee and may request an optional tip.

However, Varo’s cash advances are funded immediately, and the app does not require users to leave tips.

9. MoneyLion

The Early Payday Apps, such as the MoneyLion app, provide convenient banking and investment account services, as well as tools to track your finances.

Additionally, they offer a credit-builder loan option and the ability to get cash advances of up to $500.

The Instacash advance feature is accessible to individuals with a qualifying checking account. Members of MoneyLion can enjoy the benefits of larger advances and faster funding times.

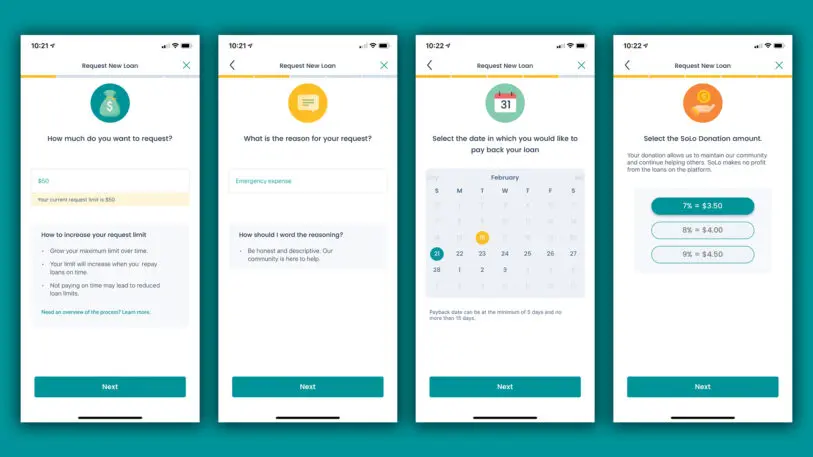

10. SoLo Funds

SoLo funds is an app that allows users to request cash advances from other consumers. Through the app’s marketplace, users can send loan requests and lenders can choose which users to lend to.

The app offers low fees, which are mostly optional, and allows users to select their own repayment dates.

However, it may take up to three days to find out if your loan request will be funded, which is a longer wait time compared to other apps that approve and send advances more quickly.

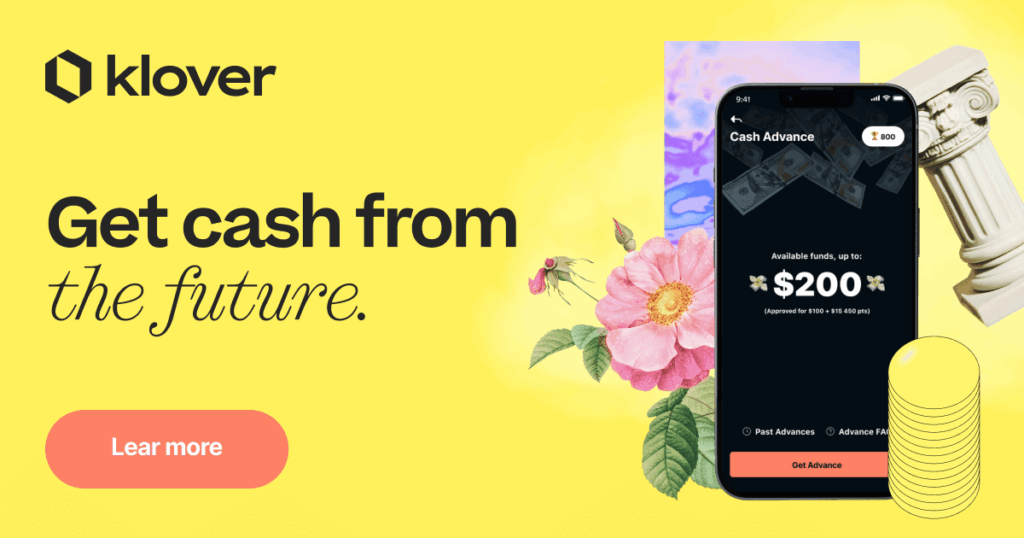

11. Klover

Klover is an app that provides early payday advances to its users. It offers two types of advances: one based on the eligibility of the user’s bank account and another based on their participation in the app’s points program.

To earn points, users need to upload receipts, complete quizzes, and watch videos. These points can later be converted into dollars, which can be used as advances or to pay for fees.

Klover generates revenue by collecting and analyzing user data, which is then shared with its partners. However, if you prioritize data privacy, Klover may not be the best choice for you.

Alternatives to cash advance apps

Before choosing a loan from an app, it is important to explore and compare all available options. There might be more affordable alternatives that can effectively improve your financial situation and credit score simultaneously.

Small personal loans

If you meet the requirements, you might be eligible for a small personal loan offered by an internet-based lender.

These loans can start at $1,000 and come with APRs lower than 36%, which is commonly regarded as the maximum interest rate for an affordable loan.

Certain online lenders even customize their loan options specifically for individuals with poor credit.

Credit union loans

If you are a credit union member, you have the opportunity to apply for a small personal loan at a lower interest rate of 18% or less.

These loans are typically offered by credit unions and can be as low as $500. While your credit score will be considered during the qualification process, being a credit union member can also play a role in the loan decision.

In addition, some credit unions provide payday alternative loans, which are small loans with low interest rates that can be repaid over a period of several months to a year.

Friend and family loans

When you find yourself in a financial pinch, it can be tough to ask for financial assistance. However, sometimes borrowing money from a trusted friend or family member can be the most suitable solution.

By doing so, you can avoid complicated procedures and potential financial risks. To ensure transparency and accountability, it’s even possible to create a contract that outlines the repayment terms and any applicable interest.

Other ways to make money

Instead of relying on loans, there are several ways to generate additional income. You can explore opportunities like becoming a rideshare driver, participating in online surveys, or offering babysitting services.

These temporary side gigs can help you manage unexpected expenses or even serve as a consistent source of extra income.

The Bottom Line

For individuals with low incomes, the time between paychecks can often feel like a significant challenge. Early payday apps can be useful in providing additional support to cover unexpected expenses.

However, it is advisable to complement the use of these apps with the establishment of an emergency savings fund. This approach ensures that you have immediate assistance from the app when necessary, while also developing better saving habits.