For individuals in various roles such as working professionals, business owners, entrepreneurs, or investors, it is crucial to possess the ability to comprehend and analyze information provided in an income statement.

This statement is considered one of the most significant financial documents produced by companies. Apart from assisting in assessing the current financial well-being of your company, this understanding can also aid in forecasting future prospects, making informed business decisions, and establishing meaningful objectives for your team.

If you lack knowledge in finance or accounting, comprehending the intricate ideas presented in financial documents may appear challenging. However, investing time in understanding financial statements like an income statement can greatly contribute to career progression.

In order to enhance your comprehension, we will provide you with a comprehensive explanation of income statements. This includes their definition, significance, and methods for analysis. By understanding these aspects, you will be able to extract maximum benefits from these financial documents.

You Might Also Like:

What Is an Income Statement?

The income statement is a crucial financial document that provides information about a company’s financial performance during a specific period. It is one of the three essential statements, along with the balance sheet and cash flow statement, that are used to report a company’s financial status.

The income statement is a financial statement that highlights the earnings, expenditures, profits, and losses disclosed by a company within a specific timeframe. It is alternatively referred to as the profit and loss statement or the statement of revenue and expense.

This statement offers valuable information about a company’s activities, the effectiveness of its management, areas where it is not performing well, and how it compares to other companies in the same industry.

Revenue and Gains

The income statement covers several aspects, but its format can vary depending on local regulations, the wide range of business operations, and the related operating activities.

Operating Revenue

Operating revenue is the term used to describe the revenue generated from a company’s main activities.

If a company is involved in manufacturing a product or is a wholesaler, distributor, or retailer selling a product, the revenue from primary activities would be the revenue earned from selling that product.

Similarly, if a company or its franchisees offer services, the revenue from primary activities would be the revenue or fees earned in exchange for providing those services.

Non-Operating Revenue

Nonoperating, recurring revenue is the income generated from secondary business activities that are not directly related to the core operations. This revenue is derived from sources other than the buying and selling of goods and services.

It can include earnings from the interest on business capital deposited in the bank, rental income from business properties, income from strategic partnerships such as royalty payments, or revenue from advertisements displayed on business properties.

Gains

The term “gains” refers to the overall profit generated from various sources apart from the core business operations. This includes the income obtained from non-recurring activities, such as the sale of long-term assets like a company’s old transportation van, unused land, or a subsidiary company. It is also known as other sundry income.

The concept of revenue should not be mistaken for receipts. In accounting, revenue is typically recognized in the period when sales are generated or services are provided. On the other hand, receipts refer to the actual cash received and are recorded at the time when the money is received.

On September 28th, a company provides goods or services to a customer, resulting in revenue recorded for the month of September. The customer, known for their exceptional credit and reputation, is granted a 30-day payment period, extending until October 28th, to settle the payment. It is during this time that the receipts are accounted for.

Expenses and Losses

The expenses incurred by a company to sustain its operations and generate profits are referred to as costs. Certain expenses may be eligible for deduction on a tax return if they meet the criteria set by the Internal Revenue Service (IRS).

Primary-Activity Expenses

An income statement is a financial document that outlines the expenses associated with generating the main source of revenue for a business.

These expenses consist of various components, including the cost of goods sold (COGS), selling, general, and administrative (SG&A) expenses, depreciation or amortization, and research and development (R&D) expenses.

The list of expenses usually includes employee wages, sales commissions, and costs related to utilities such as electricity and transportation.

Secondary-Activity Expenses

These are all expenses linked to noncore business activities, like interest paid on loan money.

Losses as Expenses

The income statement includes all the costs incurred from the sale of long-term assets that result in a loss, as well as any one-time or unusual expenses. It also takes into account expenses related to legal proceedings.

The primary revenue and expenses of a company provide information on the performance of its core business. On the other hand, secondary revenue and fees reflect the company’s involvement and expertise in managing non-core activities.

If a company generates a significant amount of interest income from the money it has in the bank, it suggests that the business may not be utilizing its available cash effectively to expand production capacity or is facing difficulties in increasing market share in a competitive environment.

The company is maximizing its resources and assets by generating recurring rental income through hosting billboards at its factory located along a highway, which contributes to increased profitability.

How to read an income statement

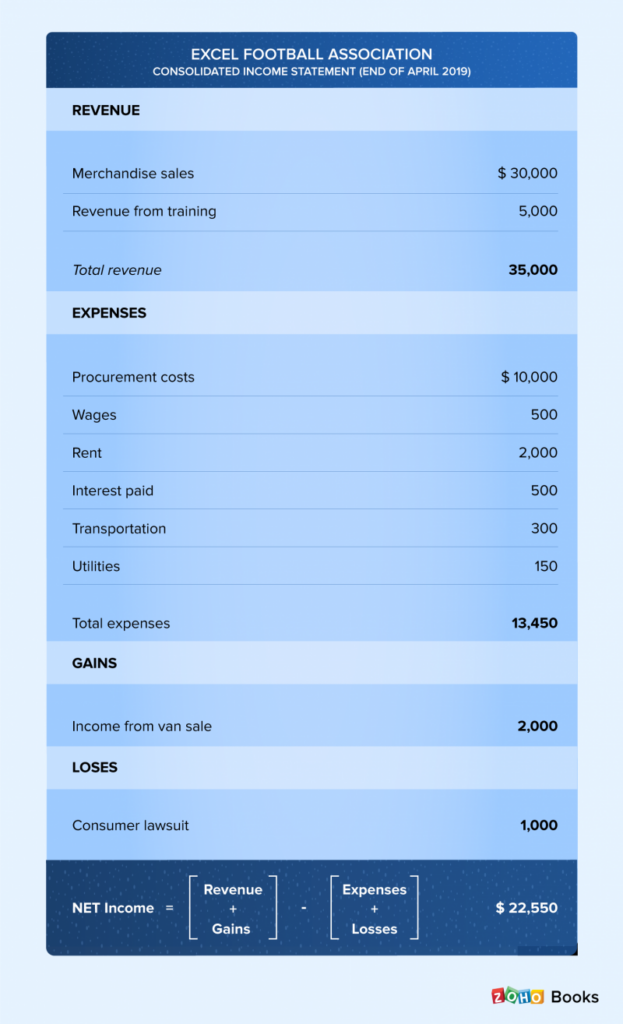

To gain a clear understanding of an income statement, let’s examine an illustration. We will be looking at the income statement of a newly established local football association for the first quarter of the current year.

In the given illustration, it is evident that the organization generated a revenue of $30,000 through the sale of goods and an additional $5,000 through training fees. The association incurred expenses for different activities, resulting in a total expenditure of $13,450.

They obtained $2,000 from the sale of a used van but experienced a loss of $1,000 due to resolving a pending consumer lawsuit. Now, to determine the net income, we can input these values into the following equation:

Net Income = (Revenue + Gains) – (Expenses + Losses)

= (35,000 + 2,000) – (13,450 + 1,000) = $22,550

This particular example is a basic form of an income statement, which involves calculating the values of income, expenses, gains, and losses to determine the net income. Due to its straightforward calculation method, it is referred to as a single-step income statement.

Reading Income Statements

The main objective of the standard format is to determine the profit or income for each category of revenue and operating expenses. Additionally, it considers mandatory taxes, interest, and any exceptional or one-time events to calculate the net income applicable to common stock.

While the calculations involve basic arithmetic operations like addition and subtraction, the arrangement and connections between the different entries in the statement often become repetitive and complex. To gain a clearer comprehension, let’s thoroughly examine these figures.

Revenue Section

The initial section of the income statement, labeled as Revenue, reveals that Microsoft achieved a gross profit of $115.86 billion in the fiscal year that concluded on June 30, 2021. This profit was calculated by subtracting the cost of revenue, which amounted to $52.23 billion, from the total revenue of $168.09 billion generated by the technology giant throughout the year.

Microsoft allocated approximately 30% of its total sales towards revenue generation costs. In comparison, Walmart’s percentage for the same fiscal year was approximately 75% ($429 billion out of $572.75 billion). This indicates that Walmart incurred significantly higher expenses than Microsoft in order to generate similar sales.

Operating Expenses

In the following section, known as Operating Expenses, Microsoft’s cost of revenue ($52.23 billion) and total revenue ($168.09 billion) for the fiscal year are taken into consideration to determine the reported figures.

Additionally, Microsoft allocated $20.72 billion towards research and development (R&D) and $25.23 billion towards selling, general, and administrative (SG&A) expenses. By adding these figures together ($52.23 billion + $20.72 billion + $25.23 billion = $98.18 billion), the total operating expenses are calculated.

By subtracting total operating expenses from total revenue, Walmart’s operating income for its core business activities is determined to be $69.92 billion. This operating income represents the earnings before interest and taxes (EBIT) and is later used to calculate the net income.

Comparing the different line items, it can be observed that Walmart did not allocate any funds towards research and development (R&D), but had higher selling, general, and administrative (SG&A) expenses as well as total operating expenses compared to Microsoft.

Income From Continuing Operations

In the following section, known as Income from Continuing Operations, Microsoft calculates its net income from ongoing business activities by incorporating various factors such as net other income or expenses (including one-time earnings), interest-related expenses, and relevant taxes.

The resulting net income from continuing operations for Microsoft amounts to $61.27 billion, which is approximately 60% more than Walmart’s net income of $13.67 billion.

Once any one-time events are taken into account, it is possible to determine the net income that is applicable to common shares. Microsoft’s net income of $61.27 billion is significantly higher than Walmart’s $13.67 billion.

The earnings per share metric is calculated by dividing the net income by the weighted average number of shares outstanding. In the case of Microsoft, with 7.55 billion outstanding shares, the earnings per share for 2021 amounted to $8.12 per share ($61.27 billion ÷ 7.55 billion).

Similarly, Walmart had 2.79 billion outstanding shares during that fiscal year, resulting in an earnings per share of $4.90 per share ($13.67 billion ÷ 2.79 billion).

When comparing Microsoft to Walmart, it is evident that Microsoft had lower expenses in generating the same amount of revenue. Additionally, Microsoft had higher net income from their ongoing operations and higher net income applicable to common shares.

Uses of Income Statements

An income statement serves the purpose of communicating the profitability and business operations of a company to its stakeholders. Additionally, it offers valuable information for comparing the internal activities of the company with those of other businesses and sectors.

By analyzing the income and expense elements of the statement, investors can gain an understanding of the factors that contribute to a company’s profitability.

Income statements provide valuable information that allows management to make informed decisions regarding various aspects of their business. These decisions can include expanding into new geographical locations, increasing sales efforts, expanding production capabilities, making adjustments to asset utilization, or even discontinuing certain departments or product lines.

Additionally, competitors may analyze income statements to gain insights into a company’s success factors and identify areas of focus, such as increasing research and development expenditures.

For creditors, income statements may not provide much valuable information since their main focus is on a company’s future cash flows rather than its past profitability. On the other hand, research analysts utilize income statements to evaluate a company’s performance over different time periods, such as comparing year-on-year and quarter-on-quarter results.

By examining the income statement, analysts can deduce whether a company’s initiatives to decrease sales costs have positively impacted its profits over time or if the management has effectively controlled operating expenses without sacrificing profitability.

What are the main parts of an income statement?.

Here are the main elements of an income statement:

1. Revenue

The income statement, also called the revenue statement, showcases the financial earnings a company has generated from the sale of its products and services within a specific time frame. This revenue figure specifically encompasses the profits obtained from the fundamental activities of the business, which are directly linked to its primary operations.

To illustrate, let’s consider a company that produces industrial machines. In the income statement, the revenue would consist of the profits generated specifically from this manufacturing activity. However, any income obtained through the sale of a building or from financial investments would be recorded in different sections of the income statement.

2. Cost of goods sold/cost of sales

The income statement of a manufacturing company includes the cost of goods sold, while retailers and wholesalers refer to it as the cost of sales.

This cost includes all the direct expenses incurred in the production or acquisition of the company’s products or services.

It encompasses raw materials, labor, and amortization expenses. However, indirect costs like administration, marketing, sales, or distribution are not included in this calculation.

3. Gross profit

The income statement is a financial statement that calculates the gross profit of a company by subtracting the cost of goods sold or cost of sales from its revenue.

The income statement includes the calculation of gross profit, which is a crucial measure of profitability. It is commonly used to determine the gross profit margin, which serves as an indicator of a company’s efficiency. Comparing this metric to other companies in the same industry can provide valuable insights.

4. Operating expenses

The income statement displays the financial costs associated with the overall operation of a business. These costs, known as operating expenses or SG&A (selling, general, and administrative expenses), encompass various indirect expenditures. They can include:

- office supplies

- maintenance and repairs

- employee benefits

- accounting and legal fees

- property taxes

- rent and utilities

- marketing and advertising

- insurance

5. Operating income

The income statement shows the amount of operating income remaining after deducting operating expenses from gross profit.

6. Non-operating items

Income Statement is a financial document that showcases a company’s revenue and expenses from its core operations.

- interest

- dividends

- one-time items such as asset sale earnings or relocation costs

7. Earnings before taxes (EBT)

Income before taxes, also known as earnings before taxes, refers to the remaining amount of money after deducting all expenses and losses from total revenue and gains. EBT is commonly utilized as a measure of profitability since companies face varying tax rates based on their geographical location.

8. Net income

The income statement shows the net income or net profit, which is the remaining amount after deducting income taxes from EBT (earnings before taxes). Net income is a crucial figure that helps calculate various useful indicators and metrics.

- net profit margin, a widely used profitability indicator of that can be benchmarked against industry peers

- EBITDA (earnings before interest, taxes, depreciation and amortization)

How do you analyze an income statement?

1. Bottom line

When analyzing a company’s financial performance, it is important to examine the net income to determine whether the company is generating a profit and how the profit amount has fluctuated over time.

To gain a more comprehensive understanding, it is also beneficial to calculate and compare the net profit margin. Additionally, it is crucial to assess the possible factors that may have contributed to any changes observed in both net profit and net profit margin.

2. Vertical analysis

Begin with the cost of goods sold or cost of sales, and then proceed to calculate each line item as a percentage of revenue. By doing this, you can determine the impact of different expenses on your profitability and identify specific areas where improvements can be made.

3. Time series analysis

When analyzing an income statement, it is important to compare each line item to previous years in terms of both raw dollar amounts and as a percentage of revenue. This comparative analysis helps to gain insights into the reasons behind any changes in profitability and provides an opportunity to brainstorm ways to enhance

4. Notes to the financial statements

Take a thorough look at the explanations provided in the notes accompanying the financial statements. This crucial part of the financial statements, typically prepared by accountants, reveals the assumptions made when creating the income statement and provides essential information for interpreting and analyzing the figures.

What Is the Difference Between Operating Revenue and Non-Operating Revenue?

The main source of revenue for a business is generated through its primary activity, which involves selling its products or services. On the other hand, non-operating revenue is obtained from additional sources such as interest income earned from funds deposited in a bank or income generated from renting out business property.

Conclusion

The income statement is a valuable tool for understanding the main contributors to a company’s profitability. It provides up-to-date information as it is generated more frequently than other financial statements.

By displaying a company’s expenses, income, gains, and losses, the income statement allows for a calculation of the net profit or loss for a specific time period. This data aids in making prompt decisions to ensure the financial stability of your business.